一、引言 在过去的十年里,加密货币经历了飞速发展,并逐渐进入公众视野。作为这一创新领域中的一颗新星,“宝...

Cryptocurrency has emerged as a revolutionary form of digital currency, with Bitcoin and Ethereum leading the charge. As its popularity grows, so does the question of how governments can and will regulate and tax this new form of currency. The idea of taxing cryptocurrency transactions is complex and varies significantly from one jurisdiction to another. This article will delve into the extent to which cryptocurrency can be taxed, the challenges associated with this taxation, and the implications for users in the modern economy.

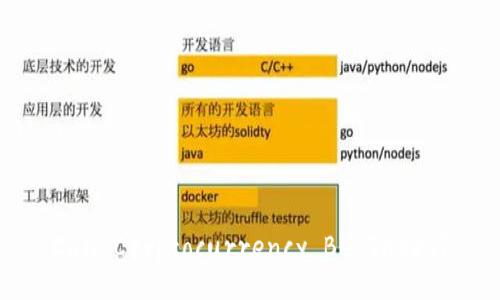

Cryptocurrency is a decentralized digital currency that employs cryptographic techniques for secure financial transactions. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on blockchain technology, a distributed ledger that records all transactions across a network of computers. This feature provides transparency and security, but it also complicates the proactive regulation and taxation of cryptocurrencies.

Most notable cryptocurrencies, such as Bitcoin, are regarded as assets rather than currency by many tax authorities worldwide. This classification brings unique challenges as they generate capital gains or losses similar to stocks and real estate.

In many countries, the taxation of cryptocurrency is evolving. For example, in the United States, the Internal Revenue Service (IRS) treats cryptocurrencies as property, meaning that various tax implications arise from their sale or exchange. Cryptocurrency holders may be required to report capital gains or losses realized from trading them, akin to transactions involving stocks or bonds. The idea is that if you sell your cryptocurrency for more than you paid, you owe taxes on the profit.

Similarly, in countries like Canada, Australia, and the United Kingdom, authorities have also provided guidelines indicating that cryptocurrencies are subject to capital gains tax. However, the rules can become complicated due to factors like airdrops, hard forks, and exchanges between different cryptocurrencies. Understanding and navigating these regulations is critical for individuals and businesses involved in cryptocurrency transactions.

The task of taxing cryptocurrency presents significant challenges for authorities. The predominantly anonymous nature of transactions may hinder the ability to accurately track income and capital gains. For instance, peer-to-peer transactions, which often lack intermediaries, can complicate record-keeping.

Furthermore, the global nature of cryptocurrency exchanges means that transactions often occur across borders—an issue that complicates tax jurisdiction. Tax authorities are struggling to keep pace with creativity among investors and traders who look to minimize their tax liabilities, whether legally or otherwise.

The impact of cryptocurrency taxation is significant for investors and traders. On one hand, proper taxation can lend legitimacy to cryptocurrencies and encourage more widespread use and adoption, attracting institutional investors and prompting businesses to accept digital currencies for goods and services.

On the other hand, high taxes or unclear regulations might deter new investors from entering the market or push existing investors to relocate to jurisdictions with more favorable tax structures. This could pose a threat to the growth of the cryptocurrency ecosystem and potentially stifle innovation.

As the cryptocurrency market matures, various models for taxation may be explored. Governments may consider simplified taxation schemes for smaller transactions or innovations in tax collection, perhaps utilizing blockchain technology itself to enforce compliant transaction recording. These solutions may bridge the gap between compliance and investment appeal, creating a safer environment for participation.

The tax implications for cryptocurrency trades can vary widely based on jurisdiction. As mentioned earlier, many countries treat cryptocurrency as property for tax purposes. This means that any swap or cashing out of cryptocurrency can trigger capital gains taxes. For instance, if a trader purchases Bitcoin at $10,000 and later sells it at $15,000, the $5,000 profit is subject to tax. However, maintaining accurate records can be challenging, especially with frequent trading or transactions involving various cryptocurrencies. Governments may implement measures to encourage proper reporting, including penalties for non-compliance.

In some regions, the IRS has introduced forms like Form 8949 to report capital gains and losses from cryptocurrency transactions. Similarly, other countries have created their reporting procedures. Therefore, understanding the local tax code is crucial for cryptocurrency investors and businesses operating in the space.

Minimizing tax liabilities from cryptocurrency is a topic of great interest to many investors. Some strategies may include holding onto cryptocurrencies for over a year to qualify for long-term capital gains tax rates, which are often lower than short-term rates. Other strategies might involve offsetting gains with losses, known as tax-loss harvesting. This technique involves selling some assets at a loss to lower overall taxable income.

Furthermore, some jurisdictions have specific allowances for small transactions and exemptions. For instance, in certain cases, transactions under a specific threshold may not be subject to taxes. Consulting with a tax professional specializing in cryptocurrency can help navigate the maze of exemptions and deductions applicable to individual situations.

Jurisdictions vary in their approach to taxing cryptocurrency, leading to a patchwork of regulations globally. For instance, while the U.S. treats cryptocurrency as property for taxation, Japan recognizes Bitcoin as legal tender, although it is still subject to consumption tax. Countries like Portugal have sought to appeal to cryptocurrency users by providing a more favorable tax environment, exempting long-term capital gains from taxes under specific conditions.

In contrast, some nations have outright banned cryptocurrency activities or imposed heavy taxation, which can stifle innovation and deter investment. The key for cryptocurrency investors looking to optimize their tax burden lies in understanding the regulations in their respective countries, as well as the potential opportunities in other jurisdictions. This complex landscape can lead to legal challenges, especially for businesses operating internationally.

Failing to report cryptocurrency transactions can lead to serious consequences, including penalties, interest charges, and in severe cases, criminal prosecution. Many tax authorities are increasingly investing in surveillance strategies to track down non-compliance, such as purchasing data from cryptocurrency exchanges that track user activity. Users might find themselves receiving letters from tax authorities demanding clarification on unreported gains or the origin of their assets.

In many regions, the penalties for not reporting can escalate quickly, leading to hefty fines that far exceed the unpaid taxes. Furthermore, a failure to comply could result in long-term issues, including an inability to regain a considered "good standing" with tax authorities or complications in potential future legal matters. Therefore, seeking professional advice and ensuring proper compliance with relevant regulations is vital for cryptocurrency investors.

Governments can take several steps to improve their cryptocurrency taxation frameworks. First, establishing clear guidelines regarding the tax treatment of cryptocurrencies would foster compliance and transparency. Creating a standardized reporting process, perhaps using digital platforms that track transactions, could simplify compliance for users.

Additionally, creating a more public-facing dialogue with the cryptocurrency community may also yield valuable insights into how taxation can evolve in line with traders' and investors' realities. Recognizing the dynamic nature of cryptocurrency, governments may benefit from adopting a more flexible, adaptive approach rather than an overly rigid regulatory framework.

Ultimately, striking a balance between regulation and innovation is crucial. Governments should aim to create an environment that encourages growth while ensuring that tax obligations are met. By engaging with stakeholders in the cryptocurrency space, authorities can craft policies that benefit the economy while safeguarding public interests.

The taxation of cryptocurrency is an evolving and complex area with far-reaching implications for investors, businesses, and governments worldwide. As the cryptocurrency market continues to develop, ongoing dialogue between stakeholders is vital to shape equitable and efficient taxation frameworks. For individuals engaged in cryptocurrency transactions, remaining informed and compliant with relevant regulations not only ensures legal standing but contributes to the broader acceptance and integration of this innovative financial technology into the mainstream economy.